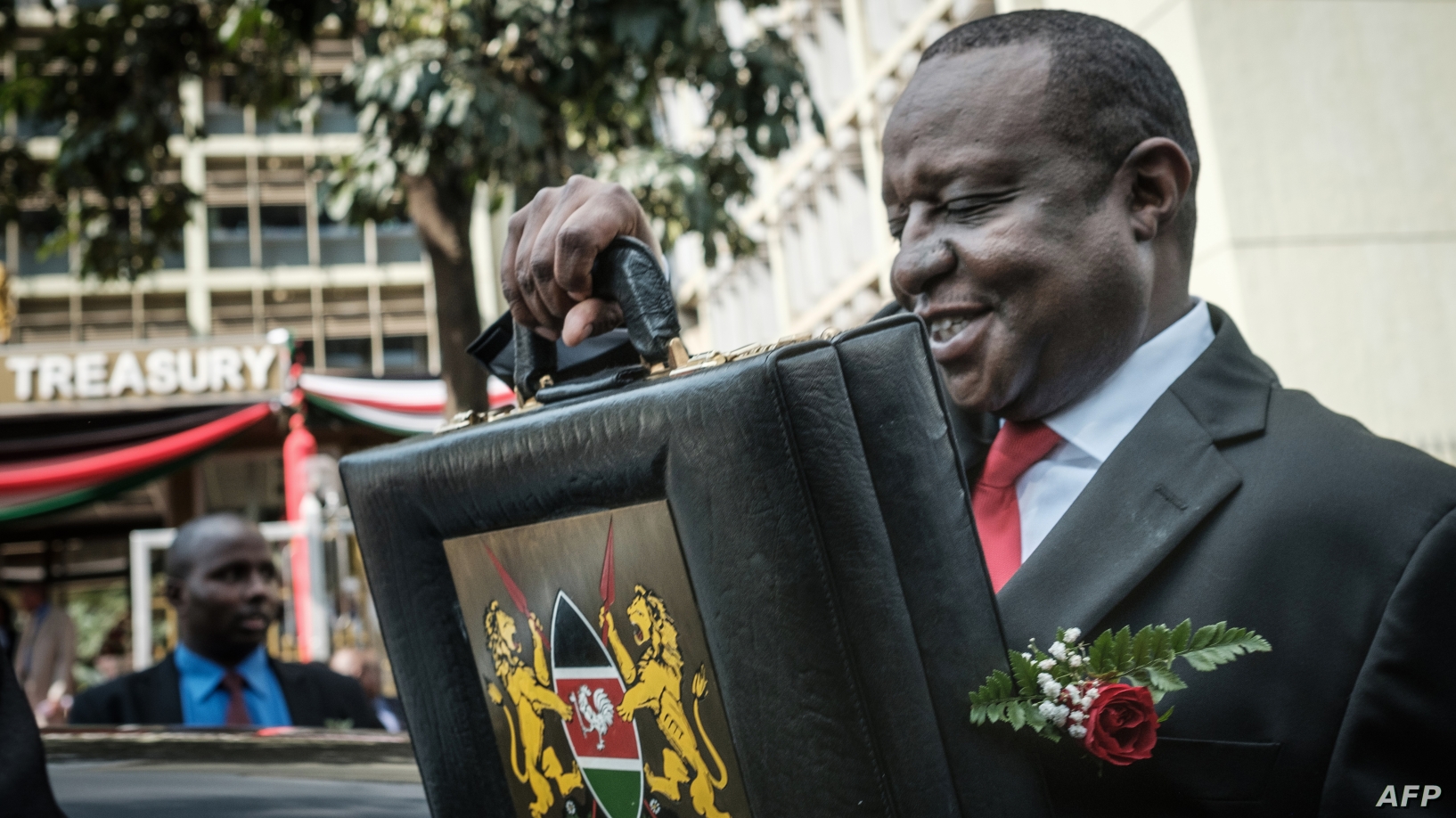

Henry Rotich, a familiar figure in Kenyan public finance, led the efforts to secure Kenya’s first $2 billion Eurobond in 2014 during his tenure as Treasury Cabinet Secretary. This Eurobond, however, has posed challenges for the current government as it navigates ways to settle it without adversely affecting forex reserves and the Kenyan shilling.

Recently appointed as President Ruto’s senior advisor for fiscal affairs and budget policy, Rotich’s return coincides with Kenya’s return to the international bond market for the first time since 2021. The aim is to raise funds for a buyback of the 10-year $2 billion Eurobond.

Rotich, known for playing his cards close to his chest, refrained from revealing his plans or offering insights into the upcoming Eurobond. Despite recent exoneration from the Arror and Kimwarer dams scandal, Rotich declined to comment on his immediate plans, emphasizing a desire to settle into his new role first.

Having served in President Uhuru Kenyatta’s Cabinet for six years, Rotich played a significant role in innovative financial initiatives, including the world’s first Treasury bond offered exclusively via mobile phone. However, his tenure was marred by corruption allegations, arrest, and removal from service.

Rotich faced parliamentary investigations in 2018 over alleged illegalities in sugar imports. In 2019, he was arrested on corruption charges related to the construction of Arror and Kimwarer dams. His new appointment raises questions about its timing as Kenya re-enters the Eurobond market, considering Rotich’s association with the previous issuance in 2018.

In 2018, under Rotich’s leadership, Kenya raised $2 billion in a highly oversubscribed sovereign bond issue, indicating international investor confidence in the country’s economic prospects. This Monday, Kenya returns to the global market for another Eurobond, alleviating concerns about its ability to repay maturing debt in June.

Rotich’s future role, pending approval, will involve collaborating with former colleague Dr. Thugge to facilitate yet another Eurobond issuance for Kenya.