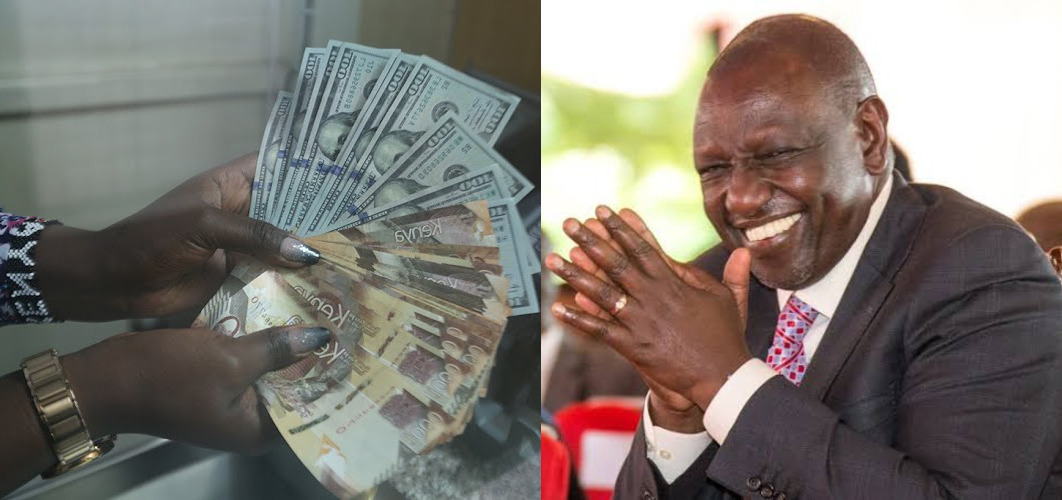

For nearly a month, the Kenyan shilling has been on a steady rise against the dollar, marking a significant appreciation. Just weeks ago, the average exchange rate against the dollar was above 160, but now one dollar equals Ksh. 134. President William Ruto attributes this appreciation to a sign of salvaging Kenya’s once struggling economy. However, despite the positive trend, some factors have raised concerns among Kenyans.

One major concern is the decline in diaspora remittance inflows recorded in February 2024. According to Central Bank of Kenya (CBK) data, remittances dropped by 6.4% compared to January 2024, with the USA diaspora being the largest contributor. This decline suggests that as the shilling appreciates, recipients have less money to spend or invest locally.

Another factor is the increase in the Central Bank Rate (CBR) to 13%, implemented to stabilize the shilling’s valuation and curb rapid depreciation. Additionally, the government’s move to execute a buyback of the maturing $2 billion Eurobond and secure loans from international bodies injected confidence in the local currency.

Despite these positive developments, stakeholders are anxious about the implications of the shilling’s rebound. Exporters, financial institutions, and individuals with high hard currency deposits may face challenges as the value of the shilling strengthens. Furthermore, uncertainties surround the government-to-government oil deal and its impact on the economy.

While recent fuel price reductions and the strengthening shilling offer some relief, Kenya still faces socio-economic challenges and debt concerns. To maintain a stable shilling, the country must focus on export-driven growth, a robust manufacturing sector, and prudent debt management. Expanding tourism offerings and promoting health tourism could also bolster the economy.

In conclusion, Kenya’s efforts to strengthen the shilling must be accompanied by sound economic policies and strategic initiatives to foster sustainable socio-economic development.