Nation Media Group Reports Sh254 Million Loss for 2024, Citing Tough Economic Climate and Shifting Media Trends

Nation Media Group (NMG) has posted a second consecutive annual loss, signaling continued financial distress amid macroeconomic challenges and rapid changes in media consumption habits.

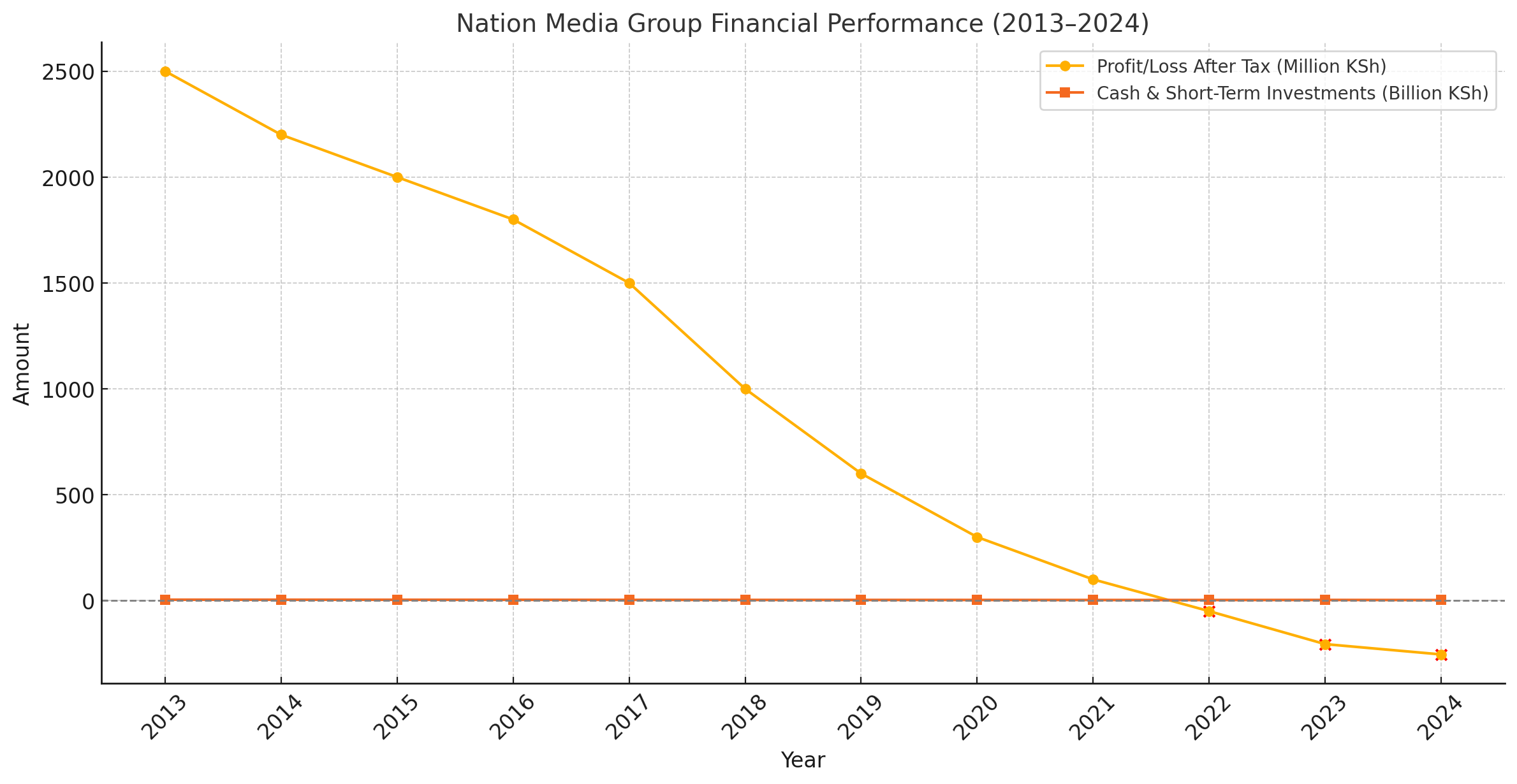

In its audited results for the financial year ending December 31, 2024, NMG reported a loss after tax of Sh254.4 million, up from a loss of Sh205.7 million the previous year. This marks the first time in over a decade that the Nairobi Securities Exchange-listed media firm has recorded back-to-back annual losses.

Declining Revenue and Shrinking Assets

The company’s turnover fell by 12.5% to Sh6.2 billion, while gross profit contracted by 9.08% to Sh4.3 billion. The firm’s total assets dropped to Sh7.5 billion, representing an 8.6% decrease from the previous year.

NMG cited tough economic conditions and shrinking advertiser budgets as key contributors to its underperformance.

Digital Business the Lone Bright Spot

Despite the downturn, NMG’s digital segment recorded positive growth, expanding by 11% year-on-year. The company’s digital audience grew by 2.2 million, closing the year with 62.4 million users across its platforms.

This growth reflects NMG’s ongoing shift toward digital transformation, even as the print and broadcast segments continue to experience mounting pressure.

Cost Cuts and Restructuring Measures

In response to declining revenues, the company implemented cost-cutting measures, leading to a 17.2% reduction in operating costs and an 18.9% drop in cost of sales. However, the media house incurred a one-off restructuring charge of Sh157.8 million in June 2024, further impacting its bottom line.

No Dividends for Shareholders in 2024

Given its dismal financial performance, NMG’s board of directors has opted not to declare any dividends for the second year running. The decision is aligned with the company’s investment and recovery strategy for 2025.

The Group’s cash and short-term investments declined to Sh2.38 billion, down from Sh2.91 billion in 2023, pointing to tighter liquidity conditions and increased operational strain.

From Profit Peaks to Consecutive Losses

NMG’s current state contrasts sharply with its peak profitability in 2013, when the media giant posted over Sh2.5 billion in profits. Since then, the company has seen a gradual decline in earnings, culminating in the losses reported in 2023 and 2024.

Analysts attribute the shift to a changing media landscape, where digital disruption, ad revenue migration, and audience fragmentation have dramatically reshaped the business model for legacy media houses.

Looking Ahead: Recovery or Reinvention?

As NMG sets its sights on 2025, the company is expected to double down on digital innovation and content diversification. However, industry observers note that the firm must also tackle internal inefficiencies and rethink its legacy operations if it hopes to return to profitability.

Here’s a visual of Nation Media Group’s financial performance from 2013 to 2024:

- Blue line shows profit/loss after tax. The drop into negative territory in 2023 and 2024 marks a significant shift.

- Orange line tracks cash and short-term investments, showing a steady decline over the years.

The red dots highlight years of financial loss. Let me know if you want to explore factors behind this trend or visualize any other aspect.